If you're buying, selling, investing or refinancing real estate it's important to find out as much as possible about the value of the property asset you will have a home loan on.

That's where a Core Logic RP Data Report can come in handy. These reports provide information on the most important attributes of the property itself, and the location and postcode. CoreLogic is a key company (listed in the NYSE) behind Australian property valuation and estimation data., and monitors the sales and valuations regularly.

the CoreLogic data has broad coverage of over 98% of the Australian property and real estate market and more than 4 billion data points on file, so chances are the details about the postcode and suburb you are looking at will be in there.

What's in the Property Profile?

An RP Data Property Profile digs into the data that is available on that property. It's one of the best ways to assess if that property is worth inspecting, making a bid on, and how it has changed over time (for example, you can see prior sales history). The data on the report includes:

- Property Photos and Map (both older and more recent photos)

- Property Floor Plan

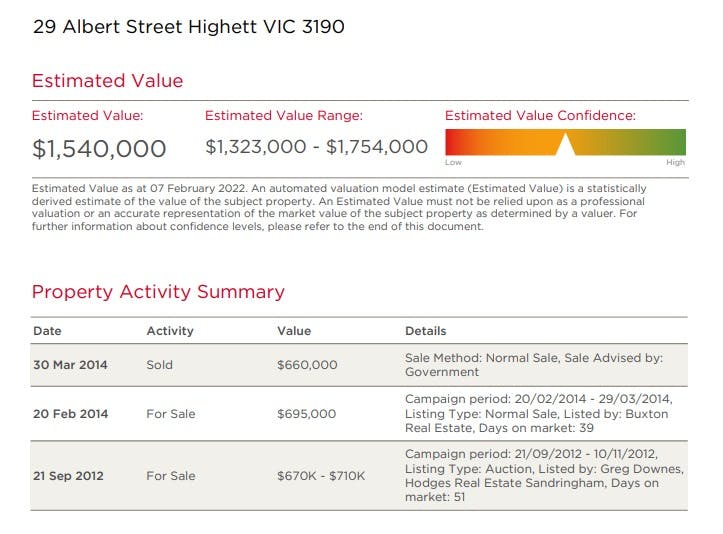

- Estimated Property Value & Value Range - now this is an important and valuable field!

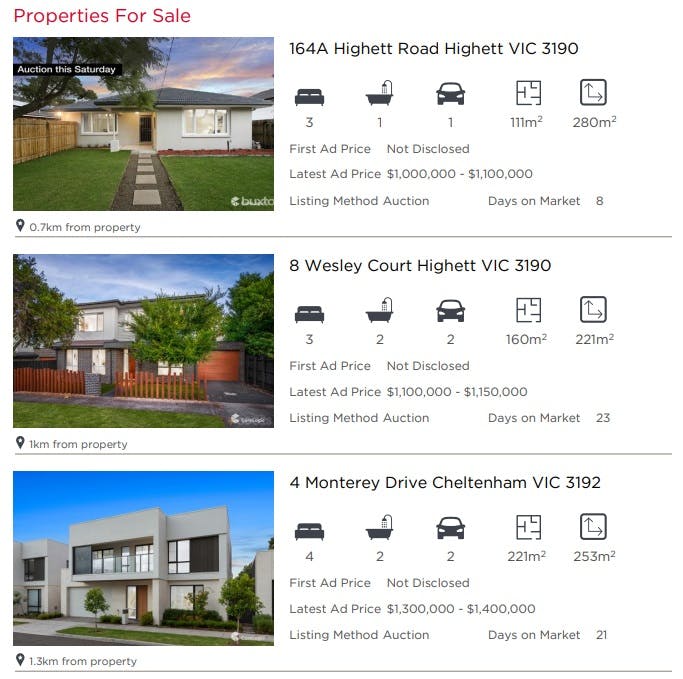

- Properties Currently For Sale

- Properties Currently For Rent

- Local School Details - (good to look out for those high performing state schools)

- Suburb Insights (like income, demographics)

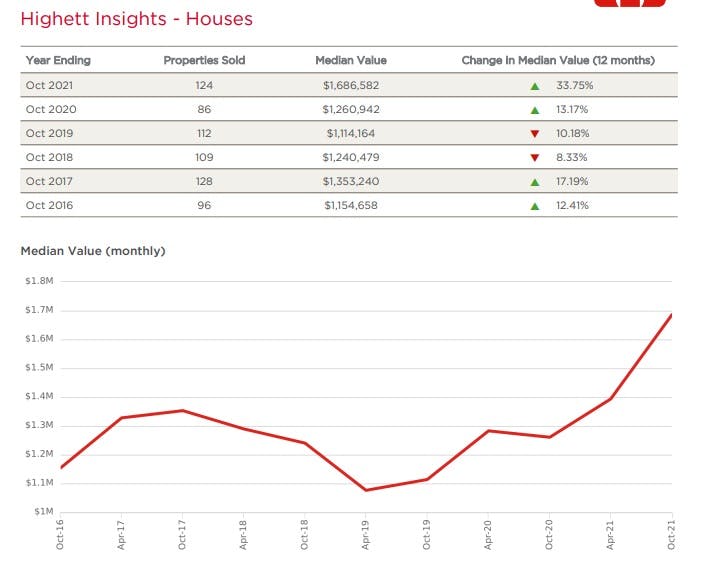

- Number of Sales

- Median Value

- Change in Median Value

- The rental history is also an interesting field, which can show you if the rent as grown or been flat over time (really useful if you will rent the property out).

- You can click here to view and flick through a PDF copy of RP Data Property Profile, for a property in Albert Street Highett, Victoria.

The great thing is that the Property Profile helps you to understand the property and the postcode, with insights such as trends in discounting, sales price increases, and growth rates of that postcode.

This is a huge help when it comes to chatting with agents on price expectations, recent sales, and even property managers when it comes time to rent out your property, as you can see what other properties have fetched in rent or sales price.

How can I access a Property Profile Report?

The standard way to get an RP Data Property Report is to head over to CoreLogic, which has property reports for sale for a fee. The standard cost is $40 for a Report. While it can be worth it, there is a more effective way to get your hands on a Report for free, via YouBroker.

What's in the Suburb Report?

If you don't have an exact address in mind, but like a suburb and think it could be a great family zone, or the next property hotspot, an RP Data Suburb Report Profile can help you assess what is going on in that postcode. A Suburb Report includes great data, such as:

- Demographic and ABS statistics of typical families and income levels in the postcode

- A trend of rents and average rent paid in the area, which allows an investor to calculate the rental yield and trends

- A trend of median and recent sales prices in the area

- Homes that have recently sold

- Homes that have come on the market and are for sale

How to get a free RP Data Property Profile?

At YouBroker, we have access to the CoreLogic Property Professional suite of tools and inside access. This allows us to access reports like Suburb Reports and Property Profile reports for you, for free.

Refinancing? Let's get you a professional valuation

RP Data Property profiles are a great starter for your real estate research. But, when it comes to getting a home loan against the property a formal valuation will be required by any bank or lender in Australia.

A formal valuation finds a value for the property based on all the factors in the CoreLogic reports but within the bank's criteria. There are three main methods for arriving at the valuation. These include:

- An "AVM", which is an automated valuation built on the same data inside CoreLogic reports and up to date statistics including comparable sales.

- A "Kerbside valuation" or "Shortform valuation", where a human valuer (a Registered Quantity Surveyor) will access the property, typically do a walkthrough of the property, and arrive at an estimated market value.

- The valuer will also use CoreLogic data to inform the report, especially the recent sales history in the area. The valuers are chosen at random, so there is impartiality in the valuation result.

- Valuers will come from leading firms such as CBRE, Jones Lang LaSalle, Opteon, and Herron Todd White.

Find your best Bank valuation

To help you with this, we at YouBroker have professional access (authorised by the banks) to CoreLogic professional research and valuations that can help you get an estimate of your available equity upfront in the process, so you know where you stand, and how much you could borrow against that property.

Lenders that we deal with include:

- Commonwealth, NAB, ANZ, and Westpac

- ING Bank, Suncorp, AMP Bank, ME Bank

- Macquarie Bank, 86400 Bank, Virgin Moey, and Bank of Queensland

- Pepper Money, Latrobe Finance, and many more.

YouBroker can arrange both a Free RP Data Property Property Profile and Valuation upfront, so you know where you stand on bank vs. bank, and go with the lender who values your house at the best level for your needs.